5 Real Estate Mistakes to Avoid in 2025 Before They Hurt in 2026

Dec 18, 2025

Written by David Dodge

In 2025, the real estate market has shown signs of cooling after years of pandemic-fueled frenzy, yet many investors continue to chase deals based on outdated assumptions. Persistent high mortgage rates around 6.6% on average, rising operating costs, and shifting regional dynamics have created pitfalls that could erode profits significantly in 2026. As the National Association of Realtors (NAR) forecasts a robust 14% increase in existing-home sales next year, driven by modestly declining rates to around 6% and growing inventory, the market is poised for more balance—but only for those who buy wisely now.

Imagine snapping up what seems like a "great deal" on a rental property in late 2025—strong rental demand, solid projected cash flow, and appreciation potential based on recent comps. Fast-forward to 2026: insurance premiums spike another 8%, property taxes rise due to reassessments, repair bills surge from deferred maintenance, and modest rent growth of just 0.3-3% fails to cover the escalating expenses. Suddenly, that positive cash flow evaporates, forcing tough decisions like dipping into reserves, raising rents aggressively (risking vacancies), or even selling at a loss in a more balanced market.

This scenario isn't hypothetical—it's playing out for many investors today. The 2025 market has been characterized by cooling sales volume, stubborn pricing echoes from pandemic highs, and mounting costs fueled by climate-related events and lingering inflation. Homeowners insurance premiums have risen dramatically, with national averages up significantly and projections for another 8% increase in 2026-2027. Property taxes are climbing in many areas due to post-pandemic reassessments and local budget needs. Meanwhile, low sales volume has made comparable sales (comps) unreliable, leading some buyers to overpay.

Why does this matter for 2026? NAR chief economist Lawrence Yun projects a meaningful rebound, with existing-home sales jumping 14% as mortgage rates ease to around 6%, job gains continue, and inventory builds. Home prices are expected to rise modestly by 3-4% nationally, though some forecasts like Redfin's predict slower 1% growth, and Realtor.com notes potential dips in 22 cities due to oversupply. In this environment, properties acquired at inflated 2025 prices or without conservative expense projections become painful holds: negative equity risks, suppressed values in high-risk zones, and eroded net operating income (NOI).

Yet, avoiding these common mistakes positions savvy investors for stronger returns. With more inventory and sales activity, well-underpriced deals will emerge for those who budget realistically and focus on fundamentals. The thesis is clear: 2025's pitfalls amplify in a 2026 market with greater balance but unrelenting cost pressures. By learning from others' errors—overpaying on stale data, ignoring insurance/tax surges, and underestimating rental OpEx—investors can thrive as the market normalizes.

Overpaying Based on Outdated Comps

One of the most persistent mistakes in 2025 is investors relying on comparable sales from the 2021-2023 peak or even early 2024 data, ignoring the slowdown and regional softening evident this year. Low sales volume has rendered many comps stale and unreliable, yet some buyers—particularly in competitive or coastal markets—continue to bid aggressively, assuming perpetual appreciation.

Data underscores the risk: In certain markets, investors have paid up to 35% above median sales prices for single-family homes, per Realtor.com analysis. This overpaying is pronounced in tight inventory areas, but even nationally, lingering pandemic pricing has left properties vulnerable. With 2025 seeing stagnant or modest sales in many regions, old comps overestimate after-repair values (ARV) for flippers and cap rates for buy-and-hold investors.

The pain hits hardest in 2026. Forecasts vary, but NAR anticipates 4% national price growth, while Redfin predicts just 1%, and some markets could see dips amid inventory buildup. Overpaid properties risk negative equity if appreciation stalls or modest corrections occur in oversupplied areas like parts of the Sun Belt. Flippers assuming high ARVs from peak comps get stuck with unsold inventory, facing carrying costs in a higher-rate environment.

Real-world examples abound: Flippers in softening markets like parts of Florida and Texas have been caught with properties lingering on the market, forcing price reductions that wipe out profits. Institutional investors, chasing yield, have contributed to localized overbidding, nudging out individual buyers and inflating bubbles in select cities.

To avoid this trap:

- Use only recent comps (last 3-6 months) and adjust downward for current inventory levels and days on market.

- Factor in buyer concessions, which are rising in balanced markets.

- Run conservative pro formas with 1-2% appreciation assumptions, not pandemic-era 10%+ jumps.

- Consult local agents or appraisers for ground-level insights on softening trends.

By buying below market with fresh data, investors position for equity gains as sales rebound in 2026.

Ignoring Skyrocketing Insurance and Tax Increases

Perhaps no cost has blindsided investors more in 2025 than surging property insurance and taxes. Premiums have jumped dramatically—national averages up 8% or more, with disaster-prone zones like Florida, California, and Midwest hail areas seeing 20-50%+ hikes as insurers exit or reprice climate risks. Property taxes follow suit, driven by reassessments capturing pandemic value gains and local funding needs.

Insurance now consumes 9-30% of housing payments in high-risk areas, per various reports, with projections for continued 8% rises into 2026-2027. Taxes directly hit NOI, compounding the erosion.

In 2026, these costs will further suppress values in vulnerable zones and squeeze cash flow as rents grow modestly (0.3-3%). Multifamily owners have reported 50-100% premium jumps, turning profitable portfolios marginal overnight.

Examples: Coastal investors in Florida facing non-renewals or doubled rates; Midwest landlords hit by hail claims driving industry-wide repricing.

Avoidance strategies:

- Shop multiple carriers annually, including surplus lines if needed.

- Mitigate risks: Fortify properties (e.g., impact-resistant roofs) for discounts.

- Budget conservatively—assume 10-15% annual insurance growth in pro formas.

- Factor taxes into cap rate calculations; appeal assessments where possible.

- Diversify geographically to avoid concentrated risk.

Smart budgeting here preserves margins as the market balances.

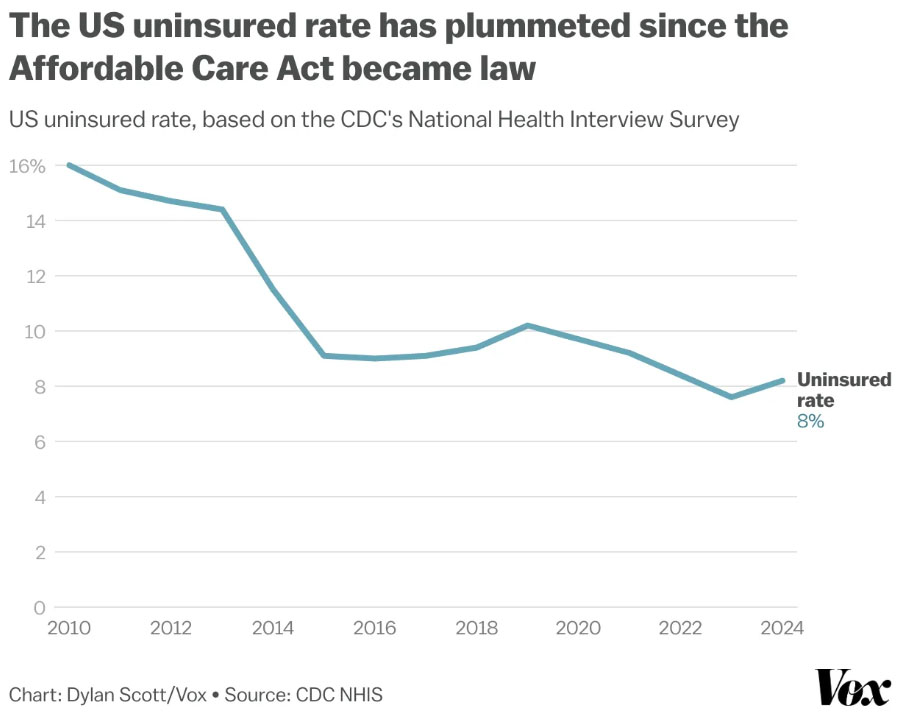

Source: CDC NHIS

Source: CDC NHIS

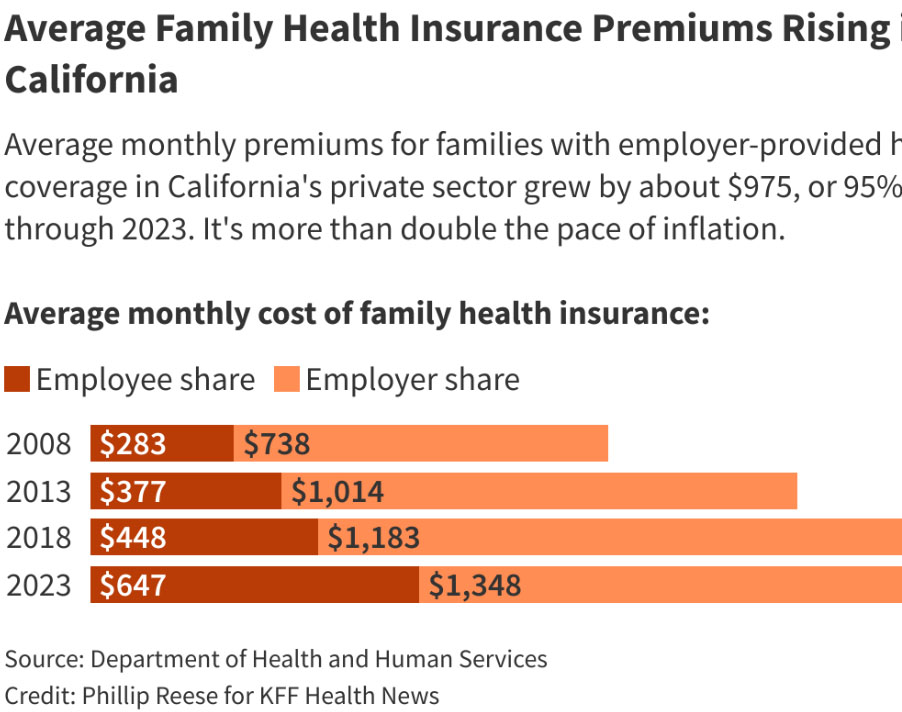

Source: Department of Health and Human Services

Underestimating Operating Costs for Rentals

Many rental investors loosely apply the "50% rule" (OpEx ~50% of gross rent) without adjusting for 2025 realities: inflated repair costs, higher utilities, compliance expenses, and turnover surprises. Maintenance, vacancies, management, and capex are routinely lowballed.

OpEx typically runs 35-50% of gross income, but 2025 inflation in materials/labor pushed many higher. With rent growth modest at 0.3-3% forecast for 2026, tight margins turn negative cash flow into forced sales.

New investors often face $200-500/month surprises from unexpected repairs or vacancies.

To sidestep:

- Apply 50% rule conservatively; reserve 5-10% gross for capex/vacancies.

- Track expenses via software for accurate forecasting.

- Build buffers for inflation in repairs/utilities.

- Plan for turnover costs (paint, cleaning, marketing).

Disciplined reserves ensure positive flow even in a modest-growth 2026.

Other Emerging Mistakes to Watch

Beyond the big three, watch for:

- Emotional buying in "hot" niches without due diligence.

- Over-leveraging, betting on sharp rate drops (forecasts show gradual easing to ~6%).

- Skipping inspections or risk assessments in climate-vulnerable areas.

These amplify losses in a more transparent 2026 market.

Conclusion

The mistakes plaguing investors in 2025—overpaying on outdated comps, ignoring insurance/tax surges, underestimating rental OpEx—will exact a heavy toll in 2026's more balanced landscape. With NAR's projected 14% sales jump, modest price growth, and persistent costs, poorly positioned properties become anchors.

Yet, the outlook is positive for disciplined investors: Growing inventory unlocks deals, sales uptick boosts liquidity, and fundamentals reward conservative underwriting. Don't let these pitfalls derail your portfolio—consult professionals, run rigorous numbers, and download a free 2026 investor checklist to stay ahead.